It doesn’t matter what your age is, how much you earn, or your station in life, the subject of money can stir up strong feelings. Losing it or living in a continuous state of survival can be catastrophic and leave psychological scars; having an abundance of it, on the other hand, can open up a plethora of possibilities but can also be overwhelming.

Although it is not recognized in the Diagnostic and Statistical Manual of Mental Disorders (DSM), which is the tool that mental health specialists all over the globe use to make diagnoses, financial, or financial post-traumatic stress disorder (PTSD) is a genuine experience of life for many. Dr. Galen Buckwalter, a clinical psychologist, provides the following definition of post-traumatic stress disorder (PTSD): “the physical, emotional, and intellectual deficiencies individuals develop when they are unable to come to grips with either sudden financial loss or the chronic anxiety that comes with insufficient financial resources.”

Even though one’s childhood can have a significant impact on how one thinks and feel about money, it isn’t the only place or time that economic trauma or post-traumatic stress disorder related to money can take root. Cathy Lammas, a Business Development Manager at Glacier by Sanlam, mentions a few of the situations that some of us may have experienced even just within the past few years, which would not only have an impact on emotional and mental health but would also be financially traumatic:

It’s possible that you were laid off from your job or that your company was forced to go out of business. You may have had to lay off some staff members at your firm. Therefore, not only would there have been an income loss but there could have been the hardship of knowing that some individuals had to be dismissed which equates to a great deal of mental trauma.

The experience of loss is not the only factor that can result in trauma. It’s possible that you could come into a windfall of money or win the lottery and then feel guilty about the resources that were made accessible to you or regretful about how you chose to use those resources.

The Question Now is, How Can You Tell if You Suffer From Money PTSD?

Your reaction to a traumatic experience concerning finances or money can take a variety of forms, depending on the coping strategies you’ve developed for yourself, how recently the event occurred, and the specifics of the traumatic experience itself. Cathy says that “red flags could be raised within a family or companionship unit if you’re continuously discussing money or about get-rich-quick schemes,” and she elaborates on this point.

Spending too much or too little money is another possible symptom. For instance, if you had limited access to financial resources when you were growing up, you might develop an extreme level of frugality as a trauma response to protect yourself from being in a similar situation again.

You might also have a low credit score, be stuck in an endless cycle of debt, or be a chronic overspender. “Going shopping will give you a rush of dopamine. Therefore, when you’re highly stressed out, nervous, and anxious, you will do whatever feels good to you to improve your mood and for many people, that means shopping.

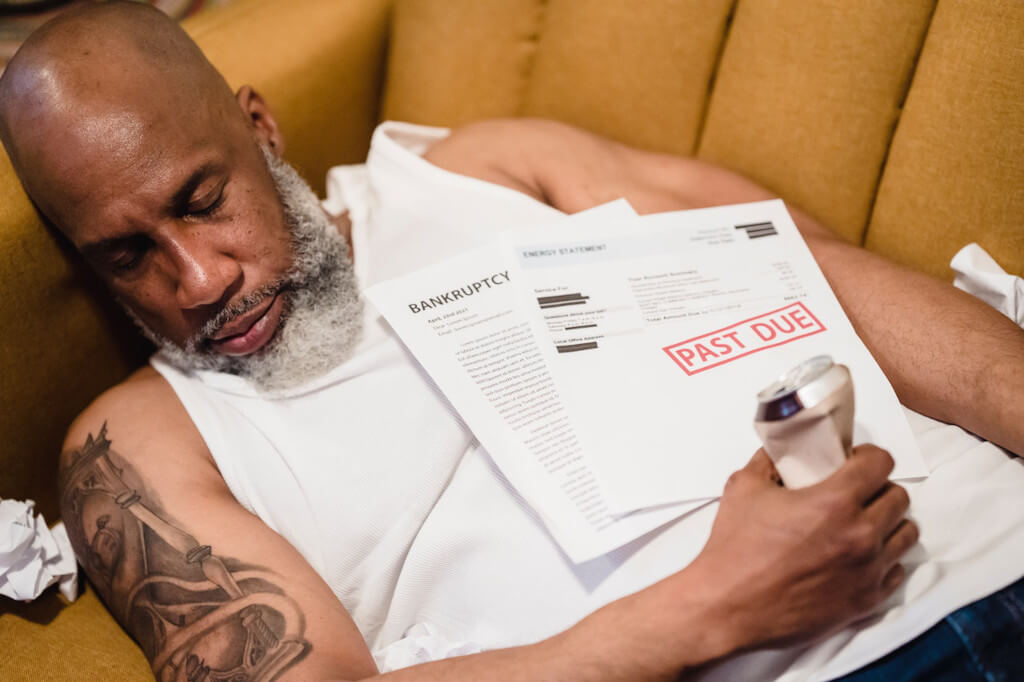

Do you try to avoid opening bills and sometimes even put them in a drawer where they can’t be seen? This could also be an indication of post-traumatic stress disorder associated with finances. Cathy asserts, “This is a typical case of denial or avoidance; simply ignoring reality,” and she is right.

Start the Process of Getting a Better

Cathy has some encouraging news to share with you: there is an opportunity for your recovery. She says that “financial trauma, like any other kind of trauma, isn’t a life sentence.” You can get back on the road to recovery and secure a stable, prosperous financial future in which you control your financial affairs rather than the other way around. Make an effort to get started by following these steps:

Acknowledge and Accept It as Normal

Cathy says that an important step in the healing process is to acknowledge the challenges that you are facing. It is essential that you discuss your predicament with others, make contact with those in your immediate circle, and ask for assistance from them. For instance, if you have recently lost your source of income or if you are currently in over your head with debt, you need to cut back on your extravagant spending, even if it’s just for the time being. If you confide in your loved ones and let them in on the details of your predicament, they may be better able to offer you meaningful support.

Talk About It With Your Independent Financial Planner

You may have gotten into the habit of engaging in financially risky behavior, in which case you need to devise a plan to break the habit so that it doesn’t put your long-term financial objectives at risk. Or, if you have recently been through a financially traumatic experience that could affect, for example, how you plan to spend your pension fund, your financial planner needs to be aware of this fact. Cathy offers the recommendation, “Let your counselor know that you’ve lost your job.” “Tell them that you are unable to continue making your monthly premium payments, and find out if there are penalties associated with this.

As the conversation continues, she explains, “Sound financial houses frequently provide solutions that permit you to freeze your premiums and impose zero consequences.”

Get the Upper Hand

Cathy also emphasizes the significance of taking charge of one’s financial situation by increasing one’s knowledge of the financial world and becoming familiar with the variety and adaptability of the financial options that are accessible to one during one’s financial journey.

Through the investment platform provided by Glacier, you will have access to the broadest possible selection of top funds, both domestically and internationally. Putting together a savings cushion for unexpected expenses is one of the most important steps you can take to protect yourself from a financially devastating emergency.

“You ought to have sufficient funds saved for the number of weeks you are likely to be without work if you are, for instance, retrenched,” she says. If you experience a traumatic event, such as the loss of your job or a divorce, having a savings cushion to rely on until you can get back on your feet can aid you to get through it.

Ask your financial planner about the different types of savings accounts that can be added to your portfolio. Your investment adviser will be able to customize your fund selection on the investment scheme so that you can achieve the highest level of personalization possible. This will ensure that your long-term and short-term investment requirements, both anticipated and unplanned, are met. Before you make any decisions concerning your savings and investments, you ought to first get the opinion of a financial professional.